1)

| Amount Previously Paid: |

2) | Form, Schedule or Registration Statement No.: |

3) | Filing Party: |

4) | Date Filed: |

| L. B.415 Holiday Drive, Suite 100

Pittsburgh, Pennsylvania 15220

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY

25, 201623, 2024

To Our Shareholders:

L. B.

L.B. Foster Company

(the “Company”) will hold its Annual Meeting of Shareholders

at the DoubleTree Hotel at 500 Mansfield Avenue, Pittsburgh, Pennsylvaniain a virtual-only format on

Wednesday,Thursday, May

25, 2016,23, 2024, at 8:

0030 AM, Eastern Daylight Time (the “Annual Meeting” or the “Meeting”)

,. You will not be able to attend the Meeting in person at a physical location. We believe that hosting a virtual Annual Meeting enables greater shareholder attendance and participation from any location around the world, improves meeting efficiency and our ability to communicate effectively with our shareholders, and reduces the cost and environmental impact of the Meeting. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/FSTR2024 you must enter the control number found on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials (the “Notice”) you previously received. Once admitted to the Meeting, you may vote during the Annual Meeting, submit questions, and view the list of shareholders entitled to vote by following the instructions available on the Meeting website. The Meeting will be held for the purposes of:

1.

| 1. | ElectingElection of a board of eight directors for the ensuing year;one-year terms; |

2.

| 2. | RatifyingRatification of the appointment of Ernst & Young LLP as ourthe Company’s independent registered public accounting firm for 2016;2024; |

| 3.

| Advisory approval of the compensation paid to the Company’s named executive officers in 2015;2023; and |

| 4.

| Approval of the L.B. Foster Company 2022 Equity and Incentive Compensation Plan (as Amended and Restated 2006 Omnibus Incentive Plan; andRestated). |

| 5. | Acting upon any other matters that properly come before the Annual Meeting. |

Shareholders will also be asked to consider and act upon such other business that properly comes before the Annual Meeting.

Shareholders are cordially invited to attend the Annual Meeting. Only holders of record of Company

Common Stockcommon stock at the close of business on March

23, 201621, 2024 will be entitled to vote at the

meetingAnnual Meeting or at any adjournment

or postponement thereof.

U.S. Securities and Exchange Commission rules allow companies to furnish proxy materials to their shareholders over the Internet. This process expedites shareholder receipt of proxy materials and lowers the cost of our Annual Meeting. On or about April

13, 2016,12, 2024, we

mailedreleased to our shareholders a Notice

of Internet Availability containing instructions on how to access our

20162024 Proxy Statement and

20152023 Annual Report and how to cast your vote. The Notice also includes instructions on how to receive a paper copy of the Annual Meeting materials.

Your vote is important. Whether you plan to attend the Annual Meeting or not, we hope you will vote your shares as soon as possible. Please sign, date, and return your proxy card or voting instruction form or vote by telephone or via the Internet; instructions are included on the

Notice, proxy card, and

votervoting instruction form.

If you plan to attend the Annual Meeting in person, please detach the Admission Ticket from your proxy card and bring it to the Meeting. If you are a beneficial owner of shares held in “street name” through a broker, bank, or other intermediary, please contact your broker, bank, or other intermediary to obtain evidence of ownership and a legal proxy, which you must bring with you to the Meeting. | |

| | | Patrick J. Guinee

|

Pittsburgh, Pennsylvania | | | Executive Vice President, General Counsel &

Corporate Secretaryand |

April 12, 2024 | |

Pittsburgh, Pennsylvania

April 13, 2016

| |

TABLE OF CONTENTS TABLE OF CONTENTS CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This Proxy Statement contains “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements include any statement that does not directly relate to any historical or current fact. Sentences containing words such as “believe,” “intend,” “strive,” “seek,” “aim,” “plan,” “may,” “expect,” “should,” “could,” “anticipate,” “estimate,” “predict,” “project,” “target,” “goal,” or their negatives, or other similar expressions of a future or forward-looking nature generally should be considered forward-looking statements. Forward-looking statements in this Proxy Statement are based on management’s current expectations and assumptions about future events that involve inherent risks and uncertainties and may concern, among other things, L.B. Foster Company’s (the “Company’s”) expectations relating to our strategy, goals, projections, and plans regarding our financial position, liquidity, capital resources, and results of operations and decisions regarding our strategic growth initiatives, market position, and product development. While the Company considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory, and other risks and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control. The Company cautions readers that various factors could cause the actual results of the Company to differ materially from those indicated by forward-looking statements. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Among the factors that could cause the actual results to differ materially from those indicated in the forward-looking statements are risks and uncertainties related to: any future global health crises, and the related social, regulatory, and economic impacts and the response thereto by the Company, our employees, our customers, and national, state, or local governments; a continuation or worsening of the adverse economic conditions in the markets we serve, including recession, the continued volatility in the prices for oil and gas, governmental travel restrictions, project delays, and budget shortfalls, or otherwise; volatility in the global capital markets, including interest rate fluctuations, which could adversely affect our ability to access the capital markets on terms that are favorable to us; restrictions on our ability to draw on our credit agreement, including as a result of any future inability to comply with restrictive covenants contained therein; a decrease in freight or transit rail traffic; environmental matters, including any costs associated with any remediation and monitoring of such matters; the risk of doing business in international markets, including compliance with anti-corruption and bribery laws, foreign currency fluctuations and inflation, global shipping disruptions, and trade restrictions or embargoes; our ability to effectuate our strategy, including cost reduction initiatives, and our ability to effectively integrate acquired businesses or to divest businesses, such as the recent dispositions of the Track Components, Chemtec, and Ties businesses, and acquisitions of the Skratch Enterprises Ltd., Intelligent Video Ltd., VanHooseCo Precast LLC, and Cougar Mountain Precast, LLC businesses and to realize anticipated benefits; costs of and impacts associated with shareholder activism; the timeliness and availability of materials from our major suppliers, as well as the impact on our access to supplies of customer preferences as to the origin of such supplies, such as customers’ concerns about conflict minerals; labor disputes; cybersecurity risks such as data security breaches, malware, ransomware, “hacking,” and identity theft, which could disrupt our business and may result in misuse or misappropriation of confidential or proprietary information, and could result in the disruption or damage to our systems, increased costs and losses, or an adverse effect to our reputation, business or financial condition; the continuing effectiveness of our ongoing implementation of an enterprise resource planning system; changes in current accounting estimates and their ultimate outcomes; the adequacy of internal and external sources of funds to meet financing needs, including our ability to negotiate any additional necessary amendments to our credit agreement or the terms of any new credit agreement, and reforms regarding the use of SOFR as a benchmark for establishing applicable interest rates; the Company’s ability to manage its working capital requirements and indebtedness; domestic and international taxes, including estimates that may impact taxes; domestic and foreign government regulations, including tariffs; economic conditions and regulatory changes caused by the United Kingdom’s exit from the European Union; geopolitical conditions, including the ongoing conflicts between Russia and Ukraine and Israel and Hamas; a lack of state or federal funding for new infrastructure projects; an increase in manufacturing or material costs; the loss of future revenues from current customers; and risks inherent in litigation and the outcome of litigation and product warranty claims. The Company cautions readers that various factors could cause the actual results of the Company to differ materially from those indicated by forward-looking statements. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The forward-looking statements in this Proxy Statement are made as of the date of this Proxy Statement and we assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by the federal securities laws. TABLE OF CONTENTS L. B.This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of L. B.L.B. Foster Company (the “Company”) to be voted at the May 25, 201623, 2024 Annual Meeting of Shareholders and at any adjournment or postponement thereof (the “Annual Meeting” or the “Meeting”). This Proxy Statement, the Notice of Internet Availability of Proxy Materials, the proxy card, and our 20152023 Annual Report to Shareholders were each made available to shareholders on the Internet, free of charge, at www.proxyvote.comor mailed on or about April 13, 2016.12, 2024. At the close of business on March 23, 2016,21, 2024, the record date for entitlement to vote at the Meeting (“Record(the “Record Date”), there were 10,341,64710,971,832 shares of common stock outstanding. Only holders of record of our common stock at the close of business on the Record Date are entitled to notice of, and to vote at, the Meeting or at any adjournment or postponement thereof. Such shareholders will have one vote for each share held on that date. The presence, in person or by proxy, of the shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast on a matter to be acted on at the Annual Meeting will constitute a quorum. Where a shareholder’s proxy or ballot is properly executed and returned but does not provide voting instructions, the shares of such shareholder will nevertheless be counted as being present at the Meeting for the purpose of determining a quorum. Abstentions and “broker non-votes” (as described below) will be counted for purposes of determining a quorum. If your shares are held in “street name” (i.e. , held for your account by a broker or other nominee), you should receive instructions from the holder of record on voting your shares. If a shareholder holds shares beneficially in street name and does not provide the shareholder’s broker with voting instructions, such shares may be treated as “broker non-votes.” Generally, broker non-votes occur when a broker is not permitted to vote on a particular matter without instructions from the beneficial owner and instructions have not been given. Brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals, such as the election of directors and executive compensation matters (for purposes of this Proxy Statement, Proposals 1, 3, and 4), although they may vote their clients’ shares on “routine” proposals, such as the ratification of the independent registered public accounting firm (for purposes of this Proxy Statement, Proposal 2). In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Directors will be elected by a plurality of the votes cast by the holders of the shares voting in person or represented by proxy at the Meeting. Only votes FOR or AGAINST this proposalWITHHELD on the election of each director nominee under Proposal 1 count as votes cast. Abstentions and brokerBroker non-votes are not considered to be votes cast for each director nominee under Proposal 1 and will have no effect on this proposal.the vote. Our common stock does not have cumulative voting rights in the election of directors. The Audit Committee of the Board has appointed Ernst & Young LLP (“Ernst & Young”) as the Company’s independent registered public accounting firm for 2016.2024. The affirmative vote of a majority of the votes cast by the Company’s shareholders entitled to vote shall ratify this appointment. Only votes FOR or AGAINST this proposal count as votes cast. Abstentions and broker non-votes are not considered to be votes cast on this proposal. Brokers have discretion to vote on this item. The advisory vote to approveapproval of the compensation paid to the Company’s named executive officers in 20152023 as reported in this Proxy Statement will be determined by the affirmative vote of a majority of the votes cast by the Company’s shareholders entitled to vote. Only votes FOR or AGAINST this proposal count as votes cast. Abstentions and broker non-votes are not considered to be votes cast on this proposal. The vote to approveapproval of on the L.B. Foster Company 2022 Equity and Incentive Compensation Plan (as Amended and Restated 2006 Omnibus IncentiveRestated) to authorize additional shares for issuance under the Plan will be determined by the affirmative vote of a majority of the votes cast by the Company’s shareholders entitled to vote. Only votes FOR or AGAINST this proposal count as votes cast. Abstentions and broker non-votes are not considered to be votes cast on this proposal.

TABLE OF CONTENTS If theyou are a shareholder of record and your form of proxy is properly executed and returned, it will be voted as directed. If no directions are given, the proxy will be voted FOR the election of each of the eight director nominees named herein as directors;for one-year terms; FOR the ratification of the appointment of Ernst & Young as the Company’s independent registered public accounting firm for 2016;2024; FOR the advisory approval of the compensation paid to the Company’s named executive officers in 2015 as reported in this Proxy Statement;2023; and FOR the approval of the L.B. Foster Company 2022 Equity and Incentive Compensation Plan (as Amended and Restated 2006 Omnibus Incentive Plan.Restated). The proxy grants discretionary authority to vote on other matters that properly come before the Annual Meeting (including to Lee B. Foster II, Chairmanadjourn the Meeting) to Raymond T. Betler, Chair of the Board of Directors, and Robert P. Bauer,John F. Kasel, President and Chief Executive Officer.Officer (“CEO”) of the Company. The voting instruction form also serves as the voting instructions for the trustees who hold shares of record for participants in the Company’s 401(k) plans. If voting instructions representing shares in the Company’s 401(k) plans are received, but no indication is provided as to how those shares are to be voted, the shares will be counted as being present at the Annual Meeting and will count toward achievement of a quorum. If voting instructions as to the shares in the Company’s 401(k) plans are not received, those shares will be voted in the same proportion as shares in the 401(k) plans for which voting instructions were received. The cost of soliciting proxies will be borne by the Company. Officers or employees of the Company may solicit proxies by mail, telephone, email, or facsimile. The Company has retained Laurel Hill Advisory Group, LLC for the solicitation of proxies and will pay its fee of $5,000$7,000.00 plus reasonable out-of-pocket expenses. If you are a shareholder of record, you may vote your shares of Company Common Stockcommon stock by telephone, or through the Internet.Internet, or by mail in advance of the Annual Meeting. You may also vote your shares by mail or in person.electronically at the Meeting. Please see the Notice of Internet Availability of Proxy Materials for instructions on how to access the proxy materials and how to cast your vote. If you are a beneficial owner of shares held in “street name” through a broker, bank, or other intermediary, you may vote by returning your voting instruction card, or by following the instructions for voting via telephone or the Internet, as provided by the bank, broker, or other intermediary. You may also vote your shares electronically during the Annual Meeting. If you own shares in different accounts or in more than one name, you may receive different voting instructions for each type of ownership. Please vote all of your shares. If you are a participant in the Company’s 401(k) plans, you must vote your shares in advance of the Annual Meeting using one of the methods described above for shareholders of record. Participants in the Company’s 401(k) plans may attend the Annual Meeting but will not be able to vote shares held in such plans electronically online during the Annual Meeting. The Annual Meeting will be held in a virtual-only format. You will not be able to attend the Meeting in person at a physical location. We have designed the virtual Annual Meeting to provide substantially the same opportunities to participate as you would have at an in-person meeting held at a physical location. To be admitted to the Annual Meeting, please log in to www.virtualshareholdermeeting.com/FSTR2024 where you must enter the control number found on your proxy card, voting instruction form, or Notice of Internet Availability you previously received. Once admitted to the Meeting, you may vote during the Annual Meeting, submit questions, and view the list of shareholders entitled to vote by following the instructions available on the Meeting website. If you have already voted by Internet, phone, or mail prior to accessing the Meeting, you do not need to vote again. Voting online during the Annual Meeting will revoke any prior votes. The virtual Annual Meeting platform is fully supported across browsers (Edge, Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Shareholders should confirm that they have a strong internet connection if they intend to attend the Annual Meeting. Attendees should allow plenty of time to log in prior to the start of the Annual Meeting. The virtual Annual Meeting format allows shareholders to communicate with us during the Annual Meeting so they can ask questions of our management and Board, as appropriate. If you wish to submit a question during the Annual Meeting, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/FSTR2024, typing your question into the “Ask a Question” field, and clicking “Submit.” TABLE OF CONTENTS Questions pertinent to the Annual Meeting will be answered in the Question and Answer session during the Annual Meeting, subject to time constraints. Any such questions that cannot be answered during the Annual Meeting due to time constraints will be posted and answered on the Company’s investor relations website, lbfostercompany.gcs-web.com under the “Governance” tab, as soon as practicable after the Annual Meeting. Votes submitted via the Internet, by telephone, or by telephonemail must be received by 11:59 PM EDT, on May 24, 2016. Submitting22, 2024. If you are a participant in the Company’s 401(k) plans, you must vote your shares two days in advance of the Annual Meeting using one of the methods described above for shareholders of record. Participants in the Company’s 401(k) plans may attend the Annual Meeting but will not be able to vote shares held in such plans electronically online during the Annual Meeting. Except as otherwise noted herein, submitting your vote via the Internet, by telephone, or by telephonemail will not affect your right to vote in person should you decide to attend the Annual Meeting.Meeting virtually. You may change your vote or revoke your proxy at any time by submitting a valid, subsequent vote by telephone or through the Internet, by submitting another properly signed proxy which bears a later date, or attendingvoting electronically during the Annual Meeting and voting in person.Meeting. Attendance at the Annual Meeting will not by itself revoke a previously granted proxy; you must also vote your shares. If you planencounter any technical difficulties in accessing the virtual Meeting, please call the technical support number that will be posted on attendingthe virtual shareholder meeting login page at www.virtualshareholdermeeting.com/FSTR2024. Technical support will be available beginning approximately 15 minutes prior to the start of the Annual Meeting in person, please detach the Admission Ticket from your proxy card and bring it to the Meeting. If you are a beneficial owner of shares held in “street name” through a broker, bank, or other intermediary, please contact your broker, bank, or other intermediary to obtain evidence of ownership and a legal proxy, which you must bring with you to the Meeting.its conclusion. TABLE OF CONTENTS PROPOSAL NO. 1 -– ELECTION OF DIRECTORS The first proposal item to be voted on is the election of eight directors.directors for one-year terms. The Board of Directors has nominated the following eight people to serve as directors, all of whom are currently serving asdirectors: Messrs. Betler, Kasel, Kunz, Meyer, and Thompson and Mses. Lee and Owen, current directors of the Company.Company, and Mr. Jones who, if elected, will succeed to Mr. Jungé’s position on the Board. Mr. Jungé is not standing for reelection at the Annual Meeting in accordance with the retirement age policy included in the Company’s Corporate Governance Guidelines. Each director who is elected will hold office until the next annual meeting and generally until the director’s successor is elected and qualified. Information concerning the nominees is set forth below with brief descriptions of each nominee’s qualifications to serve on the Company’s Board of Directors: Nominee NomineeRaymond T. Betler

| | | | | | | Robert P. Bauer | | Mr. Bauer,Betler, age 57,68, has been a director of the Company since February 2012, when2020 and Chairman since 2022. From 2014 until his retirement in 2019, he was appointed President and Chief Executive Officer. Since August 2015, Mr. Bauer has served as Officer of Westinghouse Air Brake Technologies d/b/a director of Alamo Group, Inc.Wabtec Corporation (“Wabtec”), which designs, manufactures distributes,locomotives and services equipment for infrastructure maintenance, agriculture, and other applications, including truck and tractor mounted mowing and other vegetation maintenance equipment, street sweepers, snow removal equipment, excavators, vacuum trucks, and other industrial equipment. Mr. Bauer served as President of Emerson Climate Technologies, Refrigeration Division, a business segment of Emerson Electric Co., a diversified global manufacturing and technology company, (“Emerson”) from June 2011 to February 2012. He also served as President of Emerson Network Power, Liebert Division, from January 2002 through May 2011. Mr. Bauer spent a total of 17 years with Emerson in various senior management positions and became a Group Vice President, Emerson in 2004. Prior to Emerson, he held management positions with Rockwell Automation and Westinghouse Electric. We believe that Mr. Bauer is qualified to serve as a director because of his vast experience in global manufacturing, worldwide marketing, and new product development. He also has extensive experience with mergers and acquisitions and strategic planning including investments in new technologies. | | | | Lee B. Foster II | | Mr. Foster, age 69, has been a director of the Company since 1990 and Chairman since 1998. He was the Chief Executive Officer of the Company from May 1990 until he resigned from such office in January 2002, and remained a Company employee until May 2008. Mr. Foster has been a director of Wabtec Corporation since 1999, which manufactures components for locomotives, freight cars, and passenger transit vehicles and provides aftermarket services. At Wabtec, he previously served as President and Chief Operating Officer from 2013 to 2014, as Chief Operating Officer from 2010 to 2013, and as Vice President and Group Executive of the Transit Group from 2008 to 2010. Prior to Wabtec, he worked at Westinghouse Transportation and its predecessors AEG Westinghouse Transportation, ABB Daimler Benz Transportation – Adtranz, Daimler Benz Rail Systems, and Bombardier Transportation, since 1979; Mr. Betler served as President and CEO for 15 years during his 30 year tenure with this global company. Mr. Betler was a Director of CNX Midstream Partners LP from 2017 to 2020, where he served on the audit committee, and he has been a Director of Dollar Bank since 2006, where he serves on the executive, audit, nomination and governance, and compensation committees.

Qualifications.We believe that Mr. FosterBetler is qualified to serve as a director because of his historypublic company CEO experience, valuable understanding of the rail, transportation, and energy industries, and experience in compensation and corporate governance matters. | | | | | Alexander B. Jones

| | | Mr. Jones, age 38, is Vice President and Senior Research Analyst for 22NW, LP (‘‘22NW LP”), a Seattle-based long/short small cap value hedge fund, having joined that firm in 2021. Prior to 22NW, Mr. Jones was founder and principal of Porter Street Research, LLC, a Washington, DC based investment research and advisory firm, from 2017 to 2021; an investment analyst at Legacy Research/Bonner and Partners in Washington, DC, from 2017 to 2019; an Investment Analyst at The Brookings Institution in Washington, DC, from 2015 to 2017; and a Senior Investment Associate at Cambridge Associates in Arlington, Virginia from 2008 to 2015.

Qualifications. We believe that Mr. Jones is qualified to serve as a director because he brings to the Board a valuable understanding of capital allocation and public markets and a shareholder perspective, including relating to enhancing shareholder value. See “Agreements with 22NW Fund, LP et al which describes agreements between the Company and his knowledge ofcertain shareholders regarding Mr. Jones being nominated to the Company’s current businesses,Board and his corporate governance experienceserving as a member of another public company’s board of directors. In addition, Mr. Foster’s experience brings additional insight to a variety of our business issues.Board Observer.” | | | | |

TABLE OF CONTENTS Dirk JungéJohn F. Kasel

| | | Mr. Jungé,Kasel, age 67,59, has been a director of the Company since 2015.2021 when he was appointed President and Chief Executive Officer. He isjoined the Chairman of Pitcairn Company a private Pitcairn family holding company,in 2003 and Pitcairn Trust Company, a Pennsylvania state-chartered trust company, since 1991. Until 2012, he served as Vice President – Operations and Manufacturing until 2005, introducing LEAN manufacturing and other advancements which improved operating efficiency and reliability. Mr. Kasel most recently served as Senior Vice President and Chief ExecutiveOperating Officer from 2019 to 2021; Senior Vice President – Rail & Construction from 2017 to 2019; Senior Vice President – Rail Products & Services from 2012 to 2017; and Senior Vice President – Operations and Manufacturing from 2005 to 2012. Prior to joining the Company, Mr. Kasel served as Vice President of Pitcairn,Operations for Mammoth, Inc., a recognized global leader in the specialized family office marketplace, and has overseen investments in oil and gas and drilling partnerships. SinceNortek company which produces HVAC systems, from 2000 heto 2003. He has served as a director of Paramount Resources, Ltd.,The Allegheny Conference on Community Development, a public Canadian energy company, with assignments onnonprofit, private sector organization committted to improving the corporate governance committeeeconomic future of the Pittsburgh, Pennsylvania region, since 2003 and the environmental, health & safety committee since 2011. In 2013, he joined the Board of Directors of Freeman Company, a privately held company and a leader in face-to-face marketing.March 2023.

Qualifications. We believe that Mr. JungéKasel is |

| | | Nominee | | | | | qualified to serve as a director because of his detailed knowledge of the Company’s operations, markets, and strategy; deep operational experience including LEAN manufacturing both at the Company and other corporations; and familiarity with the Company’s international presence and M&A transactions. | | | | | John E. Kunz

| | | Mr. Kunz, 59, has been a director of the Company since 2022 and was formerly Senior Vice President and Chief Financial Officer of PGT Innovations, Inc., a national leader in premium windows and doors, from 2022 until his retirement in 2023. Prior to that he served as Senior Vice President and Chief Financial Officer of U.S. Concrete, Inc., a concrete and aggregate products producer serving the construction and building materials industries, from 2017 to 2021. From 2015 to 2017, Mr. Kunz served as Vice President and Controller of Tenneco Inc., a global manufacturer of automotive emission control and ride control systems “Tenneco.” In that role he served as the company’s principal accounting officer with responsibility for the company’s corporate accounting and financial reporting globally. Prior to that, Mr. Kunz served as Tenneco’s Vice President, Treasurer and Tax, a position he held from July 2006 to 2015, preceded by his position as Tenneco’s Vice President and Treasurer, which he held from 2004 until 2006. Prior to his employment with Tenneco, Mr. Kunz was the Vice President and Treasurer of Great Lakes Chemical Corporation (“Great Lakes”), a position he held from 2001 until 2004, after holding several finance positions of increasing responsibility at Great Lakes, beginning in 1999. Mr. Kunz was a director of Wabash National Corporation, a leader of engineered solutions for the transportation, logistics, and distribution industries, from 2011 to 2022, where he previously served as chair of its audit committee, a member of the finance committee, and chair of the compensation committee.

Qualifications. We believe that Mr. Kunz is qualified to serve as a director due to his deep experience with concrete and aggregates products manufacturing serving the building products sector, financial and accounting expertise, and 13 years of businesspublic company board experience, including as chair of both an audit committee and a compensation committee. Mr. Kunz is an audit committee financial expert and brings a strong business and financial perspective to the Board to help drive shareholder value. | | | | |

TABLE OF CONTENTS Janet Lee

| | | Ms. Lee, age 60, has been a director of the Company since 2023. She currently serves as Senior Vice President, General Counsel & Secretary of ANSYS, Inc., a software company, a position she has held since 2023; she was Vice President, General Counsel & Secretary of ANSYS from 2017 through 2022. From 2010 to 2017, Ms. Lee was Vice President, Legal and Intellectual Property for HERE Technologies North America, a privately-held location and mapping company then-owned by BMW, Audi, and Daimler. Ms. Lee functioned as the Director of Nokia Research Center, Legal and Intellectual Property for Nokia Corporation from 2007 to 2010; Assistant General Counsel of America Online, Inc. from 1999 to 2007; corporate and M&A attorney for Cooley Godward, LLP from 1996 to 1999; General Counsel of Renaissance Group, a full-service investment bank in the energy sectorRussian Federation, from 1995 to 1996; and attorney at Clifford Chance in Russia from 1993 to 1995 and at Paul Weiss, Rifkind, Wharton & Garrison from 1991 to 1993.

Qualifications. We believe that Ms. Lee is qualified to serve as a director because she brings a wide range of knowledge and skills to the Board, honed through more than three decades of legal experience in both private practice and in global, public companies. In her current role, Ms. Lee has been part of a team that has overseen corporate growth from a smaller public company to a member of the Nasdaq 100; she is responsible for transactions support, product and regulatory compliance, cybersecurity, litigation, intellectual property protection, enterprise risk management, business continuity and crisis management, ethics training and investigations, data privacy, government relations, ESG matters, and employment legal support including European labor union matters. Ms. Lee brings a diverse perspective and insight to the Board. | | | | | David J. Meyer

| | | Mr. Meyer, age 54, has been a director of the Company since January 2024. He has serves as non-executive Chair of A. Stucki Company, a privately-held manufacturer of high quality freight and rail-related parts (“A. Stucki”), since 2023, and served as Executive Chair of A. Stucki from 2022 to November 2023. From 2019 to 2020, Mr. Meyer was the Chief Operating Officer of Stone Canyon Industries Rail, a private company which acquired A. Stucki in 2015 and sold it to Stellex Capital in 2022. From 1999 to 2017, Mr. Meyer served in positions of increasing responsibility at Westinghouse Airbrake Technologies Corporation (“Wabtec”), a publicly traded global provider of equipment, systems, digital solutions, and value-added services for the freight and transit rail sectors, most recently as President of its Industrial Group, and prior as Group Executive of its Transit sector. Over his tenure, he held various positions in its freight car products operations and brake systems businesses. While at Wabtec, Mr. Meyer served as a captain in the United States Army Reserve from 1995 to 2003, bringing Lean manufacturing and management to the Army Depot system while on active duty in 2002; a factory manager at Oxford Automotive Incorporated, a full-service, global tier one supplier of integrated systems based on metal forming and related technologies from 1995 to 1999; and as a manufacturing manager, product line manager, and project engineer for Eaton Corporation, a global manufacturer of highly engineered products that serve automotive, heavy truck, industrial, construction, commercial and semiconductor markets, from 1995 to 1998. Mr. Meyer also founded Northern Bel, LLC, a consulting and acquisition organization, in 2018, and was a Board member of American Track Services from 2019 to 2021. He holds seven (7) patents for various rail-related products.

Qualifications. We believe that Mr. Meyer is qualified to serve as a director of the Company due to his 28 years of manufacturing experience, including 23 years in the rail industry, the focus of the Company’s largest business segment, as a result of which he gained valuable market-specific operations and financial expertise. His engineering, manufacturing, global public and private enterprises, as well as his familiarity with strategic planning, risk management, compensation, finance,company, and governance matters, which enable him to make a valuable contributionUnited States Army skills add depth to the Board’s business and compliance oversight functions.Board in critical areas for the Company. | | | | |

TABLE OF CONTENTS Diane B. Owen

| | | Ms. Owen, age 60, was elected as68, has been a director in Mayof the Company since 2002. Since JuneFrom 2014 to 2019, she has served as an independent Board Membermember and Internal Control Committee Chairinternal control committee chair of Elliott Group Holdings, a subsidiary of Ebara Corporation, an international company that manufactures and services industrial equipment. She was Senior Vice President – Corporate Audit of H.J. Heinz Company, an international food company, from May 2010 to Juneuntil her retirement in 2013 and was Vice President - Corporate Audit of H.J. Heinz Company from April 2000 to May 2010.

Qualifications. We believe that Ms. Owen is qualified to serve as a director of the Company due to her over 30 years of business experience, particularly in accounting and finance. Ms. Owen playshas played a critical role as Chairman of the Audit Committee and as the Board’san audit committee financial expert.expert on the Board and former Chair of our Audit Committee. In addition, Ms. Owen’s extensive internationalglobal business experience enables her to provide valuable insights to the Company in its international business interests. interests and issues. | | | | | Robert S. PurgasonBruce E. Thompson

| | | Mr. Purgason,Thompson, age 60,65, has been a director of the Company since December 2014. He2022 and is President of Hospitality Development Company Group, a hotel development, management, and ownership business with several Marriott franchise hotels in operation, a position he has been Seniorheld since 2021. From 2019 to 2020, Mr. Thompson served as Vice President of The Williams Companiesand Chief Separation Officer at Arconic Inc., an industrial company specializing in lightweight metals engineering and manufacturing (“Williams”Arconic”) since January 2015,, leading the Williams operating area that encompass the assetssplit of Arconic’s rolled aluminum and operations of Access Midstream, including natural gas gathering and processing. Mr. Purgason is currently a director of Williams Partners, andmulti-material engineered products businesses. He previously served as Chief Operating Officer of the general partner of Access MidstreamVice President—Internal Audit at Arconic from 20122016 to 2015.2019. Prior to joining Access Midstream,its separation into two public companies, Arconic and Alcoa Corporation (“Alcoa”), in 2016, Mr. Purgason spent five years at Crosstex Energy Services, L.P. and was promoted to Senior Vice President-Chief Operating Officer in November 2006. Prior to Crosstex, Mr. Purgason spent 19 years with The Williams CompaniesThompson served in various senior business developmentroles at Alcoa., an aluminum industry pioneer and operational rolesglobal leader in lightweight metals technology, engineering, and manufacturing, including as Vice President—Internal Audit from 2015 to 2016, Vice President—Business Analysis and Planning from 2014 to 2015, and Director—Business Analysis and Planning from 2011 to 2014. Before joining Alcoa, Mr. Thompson was Vice President – Finance of increasing responsibility. Mr. Purgason began his career at Perry Gas Companies in Odessa, Texas working in all facets of the natural gas treating business. Mr. Purgason’s extensive experience in,Johnson Controls, Inc., a multinational conglomerate with HVAC, refrigeration, and keen understanding of, the energy industry brings valuable insight to the Board, particularly with regard to the Company’s operations which include pipe threadingsecurity controls and coatingequipment, as well as blending, injection,automotive businesses, from 2006 to 2011. From 2002 to 2005, he was the Chief Financial Officer of VITEC, LLC, a manufacturer and custody transfer metering skids for the oilsupplier of automotive fuel delivery systems. Prior to VITEC, Mr. Thompson held finance and gas industry.cross-functional positions of increasing responsibility at Ford Motor Company and Midwest Stamping Company between 1993 and 2001. He also bringsis a trustee of Howard University and a former board experience which contributes to the corporate governance experiencemember and chair of the Board. | | | | William H. Rackoff | | Mr. Rackoff, age 67, has been a director of the Company since 1996. Since 1994, Mr. Rackoff has been PresidentNational Black MBA Association between 2011 and Chief Executive Officer of ASKO, Inc., a private international company which manufactures custom engineered tooling for the metalworking industry.2020.

Qualifications. We believe that Mr. RackoffThompson is qualified to serve as a director becausedue to his yearsdecades of business experience in the steel industryaudit, accounting and his engineering background enable him to understandfinance, operations, marketing, and develop the factors that drive the Company’s performance, including strategy, operations, and finance. Mr. Rackoff, as Chairman of the Compensation Committee, has led the creation of the Company’s executive incentive programs. | | | | Suzanne B. Rowland | | Ms. Rowland, age 54, was electedcorporate strategy. He plays a critical role as a director in May 2008. Ms. Rowland was Vice PresidentBoard audit committee financial expert and General Manager in the Industrial Fire Products DivisionChair of Tyco International from 2011our Audit Committee. In addition to 2015 and was Vice President Business Excellence for the Tyco Flow Control Division from 2009 to 2010. Prior to Tyco, Ms. Rowland spent over 20 years with Rohm and Haas Company in senior executive positions including Vice President Global Adhesives, Vice President Coatings North America, and Vice President of Procurement & Logistics. We believe that Ms. Rowland is qualified to

|

| | | Nominee | | | | | serve as a director because of her 30 years of broadhis vast business leadership experience, in Fortune 500 global companies. Having served as an operating executive for the last 18 years in mechanicalMr. Thompson brings a diverse perspective and electrical products, materials, and chemicals, Ms. Rowland brings valuable insight into strategic and operational issues important to the Company’s success. | | | | Bradley S. Vizi | | Mr. Vizi, age 32, has been a director since February 2016. He is Founder and has been Managing Director of Legion Partners Asset Management since 2012. Prior to founding Legion Partners, Mr. Vizi was an investment professional for Shamrock Capital Advisors, the alternative investment vehicle of the Disney Family from 2007 to 2010. Prior to Shamrock, Mr. Vizi was a member of the private equity group at Kayne Anderson Capital Advisors. Since 2015, Mr. Vizi has served as Chairman of the Board of Directors for RCM Technologies, Inc., a public staffing and solutions company, and has been a member of its Board of Directors since 2013, serving on the compensation and governance committees. Mr. Vizi brings to the Board a valuable understanding of capital allocation and public markets, experience in compensation and corporate governance matters, and ato help drive shareholder perspective regarding enhancing stakeholder value. Mr. Vizi was elected to the Board pursuant to an agreement dated February 12, 2016 (the “Investors Agreement”) by the Company with Legion Partners, L.P. I, Legion Partners, L.P. II, Legion Partners Special Opportunities, L.P. II, Legion Partners Holdings, LLC, Legion Partners Asset Management, LLC, Legion Partners Holdings, LLC, Bradley S. Vizi, Christopher S. Kiper, and Raymond White (collectively, the “Investor Group”). |

Pursuant to the Investors Agreement, effective February 12, 2016, the Board agreed to increase the size of the Board from eight to nine members and appoint Mr. Vizi to the Board for a term expiring at the 2016 Annual Meeting. Additionally, under the terms of the Investors Agreement, the Board agreed, among other matters, to (i) appoint Mr. Vizi to the Compensation and Nomination and Governance Committees of the Board, (ii) nominate Mr. Vizi for election to the Board at the 2016 Annual Meeting and (iii) not increase the size of the Board beyond nine members without the consent of Mr. Vizi for the period commencing on the date of the Agreement and ending ten (10) days prior to the expiration of the advance notice period for the submission by shareholders of director nominations for consideration at the Company’s 2017 Annual Meeting of Shareholders (the “Standstill Period”).

The Board nominated the foregoing nominees based upon the recommendation of the Nomination and Governance Committee and, as to Mr. Vizi, pursuant to the terms of the Investors Agreement.Committee. The nominees have expressed their willingness to serve as directors, if elected. However, should any of the nominees be unavailable for election, the proxies (except for proxies that withhold authority to vote for directors) will be voted for such substitute nominee or nominees as may be chosen by the Board, or the number of directors may be reduced by appropriate action of the Board. The Board of Directors recommends that you vote “FOR” each of the foregoing nominees. TABLE OF CONTENTS PROPOSAL NO. 2 -– RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2024 Ernst & Young has served as the Company’s independent registered public accounting firm since 1990 andLLP has been appointed by the Audit Committee of the Board as the Company’s independent registered public accountantsaccounting firm for the fiscal year ending December 31, 2016.2024. Although action by the shareholders in thisAudit Committee has the sole authority to appoint the Company’s independent registered public accounting firm, as a matter is not required,of good corporate governance, the Board is seeking shareholder ratification of this appointment in light of the important role played by the independent registered public accounting firm.appointment. If the shareholders fail to ratify the selection, the Audit Committee will consider whether to retain Ernst & Young going forward.take this into consideration. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different firm at any time during the year if the committeeAudit Committee determines that such a change would be in the best interests of the Company and its shareholders. Representatives of Ernst & Young are expected to be in attendance at the Annual Meeting and available to respond to appropriate questions from shareholders and will have an opportunity to make a statement if they so desire. The Board of Directors recommends that you vote “FOR” the ratification of Ernst & Young LLP’s appointment as the Company’s independent registered public accounting firm for fiscal year 2016.2024.

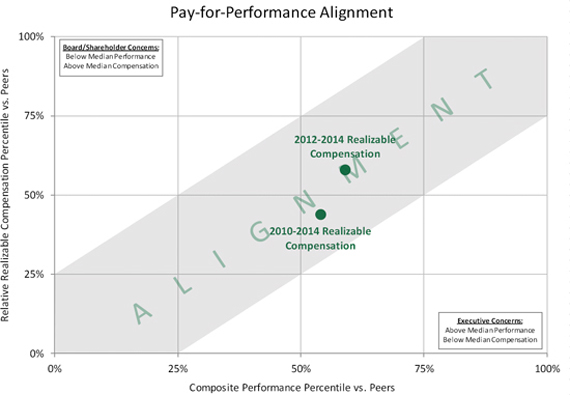

TABLE OF CONTENTS PROPOSAL NO. 3 -– ADVISORY VOTE ONAPPROVAL OF THE COMPENSATION PAID TO THECOMPANY’S NAMED EXECUTIVE OFFICERS’ 2015 COMPENSATIONOFFICERS IN 2023 At the 2011Company’s 2023 Annual Meeting, upon recommendation by the Board, of Directors, shareholders voted to hold an advisory vote on executive compensation every year. Accordingly, the Company has determined to submit an advisory vote on our executive compensation program to shareholders at each annual meeting until a new advisory vote on the frequency of such advisory votes on executive compensation is held. Subject to future advisory votes on the frequency of future advisory votes on executive compensation, with the next one occurring in 2029 we anticipate continuing to hold an advisory vote on the compensation paid to the Company’s named executive officers on an annual basis, with the next one occurring in 2025. The following proposal gives our shareholders the opportunity to vote to approve or not approve, on an advisory basis, the compensation paid to our named executive officers in 2015,2023, as described in this Proxy Statement, and is non-binding upon the Company, our Board, or the Compensation Committee of the Board. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our executive officers and our compensation philosophy, policies, and practices, as disclosed under the “Executive Compensation” section of this Proxy Statement. We are providing this vote as required by Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, we are asking our shareholders to vote “FOR” the adoption of the following resolution: ““RESOLVED, that the compensation paid to the named executive officers of L. B.L.B. Foster Company (the “Company”), as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion in the Company’s Proxy Statement for the 20162024 Annual Meeting of Shareholders under the heading entitled ‘Executive Compensation,’ is hereby approved.” The Company’s compensation programs are centered on a pay-for-performance culture and are designed to be strongly aligned with the long-term interests of shareholders. The Company’s goal for its executive compensation program is to reward executives who provide leadership for, and contribute to, the Company’s financial success. While we intend to carefully consider the voting results of this proposal, the final vote is advisory in nature and therefore not binding on the Company, our Board, or the Compensation Committee of the Board. The Board of Directors recommends that you vote “FOR” the advisory approval of the compensation paid to the Company’s named executive officers’ compensationofficers in 2015,2023, as reported in this Proxy Statement. PROPOSAL NO. 4 -– APPROVAL OF THE L.B. FOSTER COMPANY 2022 EQUITY AND INCENTIVE COMPENSATION PLAN (AS AMENDED AND RESTATED 2006 OMNIBUS INCENTIVE PLANProposal No. 4 seeks shareholder approval of the 2006 Omnibus Incentive Plan, as amended and restated.

RESTATED) Background of the 2006 Omnibus2022 Equity and Incentive Compensation Plan The

On March 29, 2024, the Board is requesting thatand the Company’sCompensation Committee (for the purposes of this proposal, the “Committee”), unanimously approved and adopted, subject to the approval of shareholders vote in favor of amending, restating and extending the term of the 2006 Omnibus Incentive Plan (the “Plan”). The Plan was approved by shareholders on May 24, 2006 and again on May 18, 2011, and currently is scheduled to terminate on May 17, 2021. We are submitting the Plan for shareholder approval at thethis Annual Meeting, in order to, among other things: | · | Increase the maximum aggregate number of shares of Company common stock that will be available for issuance under the Plan, from 900,000 shares of common stock to 1,270,000 shares of common stock; |

| · | Preserve the Company’s ability to deduct compensation earned by certain executives as qualified performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) (and approve higher limits applicable to such awards as described below); |

| · | Include additional types of awards that may be granted under the Plan, including incentive stock options and stock appreciation rights (“SARs”); |

| · | Clarify the circumstances under which shares will and will not be added back to the pool of shares available for issuance under the Plan; |

| · | Clarify the authority of the 2022 Equity and Incentive Compensation Committee of the Board (the “Committee”) with respect to the Plan; |

| · | Add one-year minimum vesting schedules, with limited exceptions, applicable to restricted stock, restricted stock units, and performance awards that may be granted under the Plan; |

| · | Expand the list of performance metrics that may be used in connection with the grant of performance awards intended to comply with Section 162(m) of the Code; |

| · | Provide that, if dividend equivalent rights are granted in connection with performance awards, the payment of such rights will be subject to the attainment of the performance goals applicable to the award; |

| · | Add a cap on the dollar amount of any award(s) specifically granted under the Plan to a non-employee director of $300,000 for any fiscal year of the Company; |

| · | Provide for a recoupment provision that makes clear that awards granted under the Plan may be subject to clawback as a result of applicable law, government regulation, stock exchange listing requirements or Company policy; and |

| · | Add administrative provisions which clarify that awards may be granted to employees in foreign jurisdictions and that the Committee may establish deferred compensation arrangements relating to awards granted under the Plan. |

The Plan is administered by the Committee, which has the full and exclusive authority to interpret, construe and administer the Plan, including, among other matters, to: (i) adopt or establish and amend such rules, regulations, agreements, guidelines, procedures, forms, and instruments as may be necessary or advisable for the administration and operation of the Plan; (ii) correct any defect, supply any omission or reconcile any inconsistency in the Plan or in any award in the manner and to the extent it deems desirable; (iii) select the persons to be granted awards under the Plan; (iv) grant and determine the terms, conditions, form and size of awards to be made to each person selected, including clawback or other recoupment provisions applicable to awards granted thereunder; (v) determine the time when awards are to be made and any conditions which must be satisfied before an award is made; (vi) establish objectives, conditions and performance goals for earning awards; (vii) determine the terms of each award agreement and any amendments or modifications thereof; (viii) determine whether the conditions for earning an award have been met and whether an award will be paid at the end of the performance period; (ix) determine if and when an award may be deferred; (x) determine whether the amount or payment of an award should be reduced or eliminated; (xi) determine the guidelines and/or procedures for the payment or exercise of awards; and (xii) determine whether to accelerate vesting provisions applicable to awards. The Committee’s decisions will be final, conclusive and binding with respect to the Plan and any award made under the Plan.

If the Company’s shareholders do not approve the Plan, the Plan will remain as currently in effect; however, the Committee will not be able to grant awards of qualified performance-based compensation that are exempt from the $1 million deduction limitation under Section 162(m) of the Code to certain executives under the Plan, as discussed more fully below under the heading “Approval of the Plan for Purposes of Section 162(m) of the Code.”

Addition of 370,000 Shares to the Plan from Prior Authorized Amount

The Committee’s independent compensation consultant, Pay Governance LLC, provided assistance with preparing the Plan. Based on an analysis of leading proxy advisory firms’ policies on equity-based compensation plans, our historical share usage under the Plan, our anticipated share usage under the Plan taking account of our current stock price, and the importance of long-term incentives in supporting the key objectives of the Company’s equity compensation program, management recommended, and the Board approved, among other changes to the Plan, the proposed increase of 370,000 shares (from the prior authorized amount of 900,000) available for issuance under the Plan, which represented approximately 3.6% of our outstanding common stock as of March 23, 2016. This increase in the number of shares available for issuance under the Plan would have had a value of approximately $5,942,200 based on the closing market price of the Company’s common stock on that date ($16.06 per share).

Description of the(as Amended and Restated, 2006 Omnibus Incentive Plan

The following summary of the major features of the Plan is qualified in its entirety by reference to the complete text of the Plan, which is attached as Appendix A to this proxy statement.

Features of the Plan:

| · | No liberal share counting“Amended Plan”). The Plan prohibits the reuse of shares issuable under the Plan that are (i) delivered in payment of the exercise price of an option or base price of a SAR or other exercise price of an award, (ii) delivered to or withheld by the Company to pay tax withholding obligations, (iii) purchased by the Company using proceeds from option exercises or (iv) not issued or delivered as a result of a net settlement of an outstanding option or SAR. |

| · | No repricing of stock options or SARs. The Plan explicitly prohibits repricing of options and SARs without first obtaining shareholder approval. |

| · | No discounted stock options or SARs. All stock options and SARs must have an exercise or base price equal to or greater than the fair market value of the underlying common stock on the grant date. |

| · | Awards are administered by an independent Committee. The Plan will be administered by the Committee, or another committee designated by the Board, which is or will be comprised entirely of independent directors. See page 23 of this Proxy Statement for more information about the Committee. |

| · | Awards subject to “clawback.” All incentive awards under the Plan are subject to any law, regulation or Company policy that requires recoupment. |

Purpose

The purpose of the Amended Plan is to advance the interests of the Company and its shareholders and promote the Company’s long-term growth and financial success by providing to our non-employee directors, officers and other employees, and certain consultants, equity and other financial incentivescash incentive awards that reward their service and performance. If approved by the shareholders at this Annual Meeting, the Amended Plan will be effective upon such approval. If the shareholder vote on the Amended Plan at this Annual Meeting is postponed, the Amended Plan will be effective on such date on which a shareholders’ meeting to vote on and approve the Amended Plan occurs, and until such time, the 2022 Equity and Incentive Compensation, as currently in effect (the “Current Plan”), will continue in effect in accordance with its terms. The Board recommends that you vote for approval of the Amended Plan. The Board believes it is in the best interests of the Company and our shareholders to approve the Amended Plan in order to continue to motivate performance by our key employees and directorsnon-employee directors. The primary amendment to the Current Plan is to increase the number of shares of common stock authorized for issuance under the Current Plan by 1,070,000 shares of common stock in addition to the number of shares currently remaining available for issuance under the Current Plan, plus any shares relating to outstanding awards under the Current Plan or the L.B. Foster Company 2006 Omnibus Incentive Compensation Plan as Amended and Restated on May 24, 2018 (the “Predecessor Plan”),

TABLE OF CONTENTS that are added (or added back) pursuant to the share counting rules of the Company. plan. As of March 1, 2024, there was an estimated maximum of 81,965 shares of common stock that remain available for issuance under the Current Plan, assuming PSUs are earned at a maximum performance level. The following table provides certain additional information regarding shares of common stock available for issuance under the Current Plan and outstanding awards issued under the Current Plan as of March 1, 2024: Shares of common stock underlying outstanding restricted stock, performance stock units (“PSUs”), and deferred stock units (assumes maximum performance for outstanding unearned PSUs) | | | 913,560 | Estimated total shares remaining available for future issuance under Current Plan | | | 81,965 |

The following is designed to provide flexibility to enable us to attract and retain the services of these individuals, upon whose judgment, interest and special effort the successful conduct of our operations is largely dependent.Eligibility

Any officer, employee, consultant, independent contractor or directora summary of the Amended Plan, which is qualified in its entirety by the complete text of the Amended Plan attached as Appendix A to this Proxy Statement. To the extent the description below differs from the Amended Plan text in Appendix A, the text of the Amended Plan governs the terms and provisions of the Amended Plan. Because Company or any of its subsidiaries isdirectors and executive officers are eligible to receive an awardawards under the Amended Plan, they may be deemed to have a personal interest in the adoption of this proposal.

The Compensation Committee will have full discretion to determine the number and amount of awards to be granted to participants under the Plan, subject to the terms of the Amended Plan. AsThe future benefits or amounts that will be awarded or paid under the Amended Plan currently are not determinable. Awards granted under the Amended Plan are within the Committee’s discretion, and the Committee has not yet determined the value or amount of December 31, 2015, there were approximately 690 salaried, exemptfuture awards or which individuals may receive them. Purposes of the Proposal Our Board and Compensation Committee determined that the adoption of the Amended Plan is necessary to reward the service and performance of our non-employee directors, officers and other employees, and certain consultants. The Board believes that a long-term equity incentive program motivates and rewards our directors, executive officers and other key individuals for their contributions to our Company’s performance and serves to align long-term compensation with the performance of Company stock. Our Board recommends a vote for approval of the Amended Plan because it will allow the Company to continue to use equity-based incentives and promote the goals of our compensation strategy. The Amended Plan will only become effective if it is approved by our shareholders and, if it is not approved, the Current Plan will continue to remain in effect. It is not possible at present to determine the amount or form of any award that will be granted or available for grant to any person in the future under the Amended Plan. Important Features of the Amended Plan | | Plan Term | | | If approved, no grant will be made under the Amended Plan on or after the tenth anniversary of the Amended Plan’s original effective date of June 2, 2022. | | | | Minimum Vesting Provisions | | | Except as otherwise provided in the Amended Plan, equity-based awards granted under the Amended Plan will generally be subject to either a minimum vesting or minimum performance period of at least one year. | | | | Limits on Non-Employee Director Compensation | | | The Amended Plan provides an overall annual cap on the amount of compensation that may be granted to each non-employee director. | | | | No Liberal Share Counting | | | Shares withheld to pay withholding tax obligations, or for the payment of option exercise prices, among other circumstances, will not be added back to the authorized share pool. | | | | No Dividends on Unvested Awards | | | No dividends or dividend equivalents with respect to options rights and appreciation rights and with respect to other awards, no dividends or dividend equivalents will be paid on awards until they | |

TABLE OF CONTENTS | | | | | are earned and/or vested. | | | | No Repricing Without Shareholder Approval | | | Option rights and appreciation rights may not be amended to reduce their exercise or base price, as applicable, and may not be cancelled in exchange for cash, other awards, or option rights and appreciation rights with an exercise or base price, as applicable, that is less than the exercise or base price of the original option rights or appreciation rights without obtaining shareholder approval. | | | | No Discounted Option Rights or Appreciation Rights | | | Option rights and appreciation rights may not be granted with an exercise or base price less than the fair market value of the Company’s common stock on the date of grant. | | | | No “Evergreen” Provisions | | | The Amended Plan authorizes the issuance of a fixed number of shares of common stock (subject to adjustment as provided therein). Shareholder approval will be required before any additional shares can be authorized for issuance under the Amended Plan. | | | | Clawback Protections | | | Pursuant to the terms of the Amended Plan, awards will be subject to recovery or recoupment under circumstances set forth in a clawback policy adopted by the Company as required by SEC and stock exchange rules. | |

Plan Summary The following summary describes the material features of the Amended Plan. The purposes of the Amended Plan are to promote the interests of the Company and its subsidiariesshareholders by: motivating and rewarding long-term strategic management that results in profitable growth and sustained shareholder value creation; aligning employee and director interests with those of shareholders through encouraging stock ownership; reinforcing a strong management team commitment to the Company’s long-term success; providing meaningful long-term incentive award opportunity as part of a competitive total compensation program that enables the Company to attract and retain its key employees; managing costs effectively through program design and administration guidelines in terms of accounting, tax, cash flow and shareholder dilution; and structuring grants to be responsive to changes in the Company’s business environment and compensation objectives. The Amended Plan will generally be administered by our Compensation Committee. Employees (including officers), non-employee directors and certain consultants of the Company and our affiliates are eligible to receive awards under the Amended Plan based on the discretion of the Compensation Committee and its designees. As of February 29, 2024, approximately 1,063 of the Company’s and its subsidiaries’ employees and currently eight of our non-employee directors and none of our consultants were eligible to participate in the Amended Plan in connection with their provision of which 33 were participating, and eight non-employee directorsservices to the Company. In connection with the Board’s consideration of the Company participatingAmended Plan, the Board reviewed leading proxy advisory firms’ policies on equity-based compensation plans, the importance of long-term incentives in supporting the Plan.The selectionkey objectives of participantsthe Company’s equity compensation program, and the natureoverall dilution and sizevalue of the awards is subject toAmended Plan as described above. The Amended Plan provides for the Committee’s discretion.following award types: stock option rights, appreciation rights, restricted stock, restricted stock units (“RSUs”), cash incentives, performance shares, performance units and other awards. The Board recommends that our shareholders approve the Amended Plan Reserve Thewhich authorizes the issuance of 1,070,000 shares of our common stock, plus (i) the number of shares reservedcurrently remaining available for issuance under the Current Plan, will be depleted by one shareplus (ii) the total number of shares of common stock remaining available for each share subject to a stock-settled award. Fractional shares will not be issuedissuance under the Plan.

ExceptPredecessor Plan (but not reserved for outstanding awards under the Predecessor Plan) as otherwise provided inof June 2, 2022 plus

TABLE OF CONTENTS (iii) any shares relating to outstanding awards under the Current Plan shares may be re-creditedor the Predecessor Plan added (or added back, as applicable) pursuant to the plan reserve if (i) an award lapses, expires, terminates, or is cancelled without the underlying shares being issued (or a portion thereof), (ii) it is determined during or at the conclusionshare counting rules of the termplan as further described herein. As of March 1, 2024, there were an awardestimated maximum of 81,965 shares of common stock that all or someremained available for issuance under the Current Plan (assuming outstanding PSUs are earned at a maximum performance level and including any shares underlyingrelating to the award may not be issued becausePredecessor Plan). Certain Limitations on Awards Under the conditions for such issuance failed to be met, (iii) any award (or a portion thereof) is settled in cash, (iv)Amended Plan, the aggregate number of shares subject to an award are forfeited, or (v) shares are issued pursuant to an award but are subsequently reacquired by the Company (except with respectrelating to incentive stock options).Individual Award Limits

The Plan provides for limits on certain types of awards thatoptions (as defined in the Amended Plan) may be granted undernot exceed 765,000 shares. Notwithstanding anything in the Amended Plan to a participant in any one fiscal year. Under the Plan, for any fiscal year and subject to adjustment in accordance with the terms of the Plan, no participant may be granted (i) an award of stock options or

SARs for more than 300,000 shares, (ii) a performance award (payable in stock) intended to be performance-based compensation under Section 162(m) of the Code of more than 150,000 shares (measured on a target award level on the grant date), or (iii) a performance award (payable in cash) intended to be performance-based compensation under Section 162(m) of the Code of more than $5,000,000 (measured on a target award level on the grant date). Additionally, and subject to adjustment in accordance with the terms of the Plan,contrary, no non-employee director may be granted, in any one fiscalcalendar year, awards specifically granted underaggregate compensation, in the Plan withform of cash and/or equity, for such service having an aggregate maximum value calculated(measured at the grant date, as applicable, and calculating the value of their respectiveany awards based on the grant dates,date fair value for financial reporting purposes), in excess of more than $300,000.

Awards

$500,000. The following typesAmended Plan provides that the aggregate number of shares available for issuance under the Amended Plan will be reduced by one share for each share subject to an award granted under the Amended Plan. Subject to the terms of the Amended Plan, if any award granted under the Amended Plan is cancelled or forfeited, expires, is settled for cash, or is unearned, the common stock subject to such award will, to the extent of such cancellation, forfeiture, expiration, cash settlement, or unearned amount, again be available for issuance under the Amended Plan. The Amended Plan further provides that if, after the effective date of the Amended Plan, any common stock subject to awards granted under the Amended Plan or the Predecessor Plan is forfeited, or awards granted under the Amended Plan or the Predecessor Plan (in whole or in part) are cancelled or forfeited, expire, are settled for cash, or are unearned, the common stock subject to such awards, to the extent of such cancellation, forfeiture, expiration, cash settlement, or unearned amount, will be available for awards under the Amended Plan. Notwithstanding the foregoing, (i) shares of common stock withheld by the Company, tendered or otherwise used in payment of the exercise price of an option right (or the exercise price of an option right granted under the Predecessor Plan) will not be added back to the aggregate number of shares of common stock available under the Amended Plan; (ii) shares of common stock withheld by the Company, tendered or otherwise used to satisfy tax withholding will not be added back to the aggregate number of shares of common stock available under the Amended Plan; (iii) shares of common stock subject to a share-settled appreciation right that are not actually issued in connection with the settlement of such appreciation right on the exercise thereof will not be added back to the aggregate number of shares of common stock available under the Amended Plan; and (iv) shares of common stock reacquired by the Company on the open market or otherwise using cash proceeds from the exercise of option rights will not be added back to the aggregate number of shares of common stock available under the Amended Plan. If a participant has elected to give up the right to receive cash compensation in exchange for shares based on fair market value, such shares will not count against the aggregate share limit of the Amended Plan. Awards may be granted under the Plan:Stock Options. Stock options may be nonqualified stock optionsAmended Plan in substitution for or incentive stock options that complyin conversion of, or in connection with Section 422 of the Code. Only an employee of the Company may receive incentive stock options. The Committee determines all terms and conditionsassumption of, stock options, includingstock appreciation rights, restricted stock, RSUs or other share or share-based awards held by awardees of an entity engaging in a corporate acquisition or merger transaction with the Company or any subsidiary. The awards so granted may reflect the original terms of the awards being assumed or substituted or converted for and need not comply with other specific terms of the Amended Plan, and may account for common stock substituted for the securities covered by the original awards and the number of shares subject to the original awards, as well as any exercise or purchase prices applicable to the original awards, adjusted to account for differences in stock prices in connection with the transaction. Any common stock that is issued or transferred by, or that is subject to any awards that are granted by, or become obligations of, the Company will not reduce the shares of common stock available for issuance or transfer under the Amended Plan or otherwise count against the share limits contained in the Amended Plan and summarized above. In addition, no shares of common stock subject to an award that is granted by, or becomes an obligation of, the Company under the Amended Plan as described in this paragraph, will be added to the aggregate share limit contained in the Amended Plan.